- As the U.S. apartment market is showing signs of growth, RentCafe ranked the most competitive rental markets in the first quarter of the year.

- Central Valley, CA, is the hottest rental market in the U.S., leading a pack of emerging mid-sized hubs spread across the nation.

- Southern mega-markets are the most in-demand large renter hubs, with five present in the ranking.

Following one of the most disruptive periods of our times, at the start of 2021, the most in demand locations for renters were certainly not the ones you would expect.

When trying to assess the competitiveness of our country’s 125 largest rental markets, we found mid-sized markets like Central Valley, CA, Spokane, WA, and Boise, ID were the most sought-after this past quarter. These emerging renter hubs share a similar story, attracting renters from larger metros with a mix of cheaper, slower living and a growing number of opportunities. Coupled with a shift towards remote work, the nation’s mid-sized renter hubs were poised to get a boost in the first quarter of the year.

“The largest markets and surrounding exurbs show renters are distinctly looking to get more square footage or more amenities for the same price, within these hubs and close to them. Residents from large gateway markets are “trading up”, and with work-from-home policies, exurb locations close to these areas are also benefitting from this behaviour.” says Doug Ressler, manager of business intelligence at Yardi Matrix.

To rank the hottest rental markets in the nation, we looked at the most revealing industry metrics when it comes to competitivity:

- what percentage of apartments were occupied

- how many days rentals were vacant

- how many prospective renters competed for apartments

- the rent price trend

On a national level, U.S. apartments were vacant for an average of 39 days during the first quarter of 2021. 94% of rentals were occupied during the time period, with an average of 11 renters competing per apartment. The rent trend score was 20 in the first three months of the year, showing slight growth.

The nation’s hottest rental markets are emerging from mid-sized places

The hottest rental markets in the nation share a common thread: with a few key exceptions, most of them are mid-sized. Central Valley, which includes rising California hubs such as Fresno, Bakersfield, Stockton and Modesto, is the hottest rental market in the nation, with a 5.5 competitive score.

Top 30 Hottest Rental Markets

Q1 2021

| Rank | Market | Competitive Score | Average Vacancy Days | Occupied Apartments | Prospective Renters | Rent Trend Score |

| 1 | Central Valley | 5.5 | 30 | 98% | 25 | 78 |

| 2 | Spokane | 10 | 31 | 97% | 32 | 77 |

| 3 | Boise | 12.25 | 30 | 97% | 31 | 76 |

| 4 | Sacramento | 13 | 31 | 97% | 24 | 77 |

| 5 | Inland Empire | 13.75 | 28 | 98% | 32 | 74 |

| 6 | Eugene | 14.5 | 29 | 97% | 23 | 75.33 |

| 7 | Lehigh Valley | 17.25 | 33 | 97% | 32 | 76 |

| 8 | Albuquerque | 23.75 | 28 | 96% | 17 | 73.33 |

| 9 | Knoxville | 24 | 29 | 97% | 24 | 69 |

| 10 | Huntsville | 24.75 | 27 | 97% | 12 | 77 |

| 10 | Eastern Virginia | 24.75 | 31 | 96% | 15 | 77.67 |

| 11 | Tacoma | 25 | 31 | 97% | 19 | 70.67 |

| 12 | Portland ME | 26.75 | 36 | 98% | 36 | 71 |

| 12 | Colorado Springs | 26.75 | 31 | 96% | 17 | 74.67 |

| 13 | Harrisburg | 29 | 40 | 96% | 18 | 78 |

| 14 | El Paso | 29.5 | 34 | 96% | 13 | 78 |

| 15 | Tucson | 30 | 31 | 96% | 14 | 75.33 |

| 16 | Tri-Cities | 30.75 | 35 | 97% | 18 | 71.33 |

| 17 | Grand Rapids | 31.25 | 37 | 96% | 16 | 76 |

| 18 | Macon | 31.5 | 26 | 95% | 15 | 75.33 |

| 18 | Providence | 31.5 | 36 | 97% | 19 | 70.33 |

| 19 | Little Rock | 34 | 21 | 96% | 11 | 74.67 |

| 20 | Pensacola | 35.25 | 26 | 96% | 16 | 65.33 |

| 21 | Renon | 38.5 | 35 | 97% | 18 | 61.67 |

| 21 | Central Coast | 38.5 | 32 | 97% | 16 | 50.33 |

| 22 | Phoenix | 39.5 | 33 | 96% | 19 | 61.67 |

| 23 | Jacksonville | 40.25 | 32 | 96% | 15 | 67.33 |

| 24 | Tampa | 40.5 | 33 | 96% | 18 | 61.67 |

| 25 | The Piedmont Triad | 40.75 | 35 | 95% | 13 | 78 |

| 25 | Memphis | 40.45 | 34 | 95% | 11 | 78 |

To see the full ranking, scroll through the table using the bar on the right.

The story behind Central Valley’s meteoric rise is becoming an archetype among the nation’s mid-sized cities. In a chicken-and-egg scenario, these markets are attracting an increasing number of residents looking for cheaper alternatives to expensive markets and shifting from traditional industries (in this case, agriculture and energy) to more diversified job markets. As the days when Central Valley was known for its pass-through cities are fading, renters have been eyeing this area more and more, turning it into the most competitive market in the U.S. in the first three months of the year. Fellow mid-sized California markets Sacramento and the Inland Empire also made it to the ranking, as more people are relocating from L.A. and the Bay Area, according to RedFin.

Spokane, WA, and Boise, ID, come in second and third, sharing a similar trajectory. With a competitive score of 10, Spokane apartments are highly sought-after by lots of prospective renters. The area has been making headlines since Amazon announced plans to open a new fulfilment center in the city, but the market has been on the rise for a while now. Spokane’s mix of small companies and well-paying government, medicine and higher-education jobs has attracted residents from the Puget Sound for years now, especially from the pricier Seattle area. Meanwhile, third-ranked Boise, ID, has become known as a prime relocation hub for Californians, since the area offers a balance between slow (and cheaper) living, short commutes and big-city amenities.

Other cities that made the top 20 hottest rental markets this quarter are: Eugene, OR; Lehigh Valley, PA; Albuquerque, NM; Knoxville, TN; Eastern Virginia, VA; Huntsville, AL; Tacoma, WA; Colorado Springs, CO; Portland, ME; Harrisburg, PA; Tucson, AZ; Tri-Cities, WA; Grand Rapids, MI; Providence, RI; Macon, GA; and Little Rock, AR.

Covering the remaining spots, from number 20 to number 30, are: Pensacola, FL; Central Coast, CA; Reno, NV; Phoenix, AZ; Jacksonville and Tampa, FL; Memphis, TN; and The Piedmont Triad, NC.

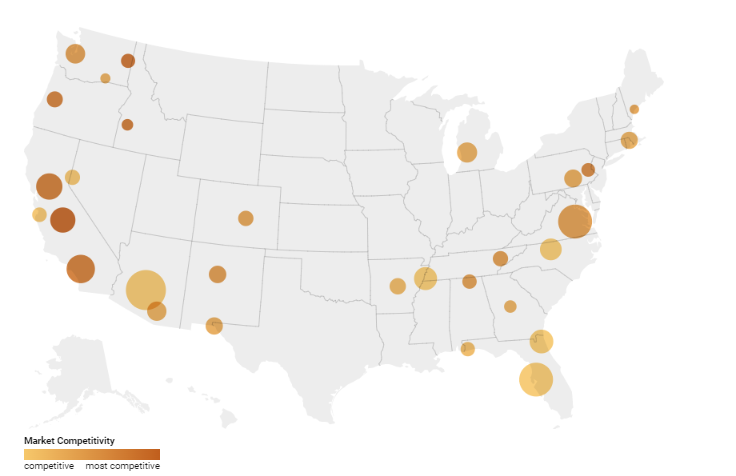

The 30 Hottest Rental Markets Mapped By Competitivity

Five of the nation’s largest renter hubs are also among the 30 hottest apartment markets, and they’re all from the South and Southwest. El Paso leads this trend with a 29.5 competitive score, ranking as the 16th hottest rental market in the nation.

Phoenix, AZ, also made it to the ranking, with a competitive score of 39.5. The Arizona job hub’s rapid growth has attracted an increasing number of renters from surrounding states over the past few years. Most recently, the market’s rising tech sector has prompted a new nickname for the area, the Silicon desert, while the local economy weathered the pandemic better than in other large markets.

“More Americans are getting vaccinated, employment is up and hybrid work models are rising, showing growth for the multifamily and commercial real estate industry. The current climate increasingly points to the economy growing in 2021, providing significant and risk-averse potential for the apartment market,” Ressler added.

Florida also has two large markets in the ranking, Jacksonville and Tampa, both scoring around 40 points. These renter hubs have been among the most quickly developing in the nation for a while — Jacksonville, in particular, was the 15th fastest growing city in the nation in the past decade. Last but not least, Memphis, TN, closely follows the two, with a 40.75 competitive score.

Methodology

To compile this report, RentCafe’s research team analyzed Yardi Systems apartment market data across 125 rental markets in the U.S. The data comes directly from competitively-rented (market-rate) large-scale multifamily properties (50+ units in size). Fully affordable properties are not included.

Markets were ranked based on a market competitivity score. To calculate each market’s competitive score, we ranked them according to four metrics and their quarterly (three-month) averages: apartment occupancy rate (occupied apartments), prospective renters per vacant unit (prospective renters), average total days vacant (average vacancy days) and yearly rent trend (rent trend score). We then compiled an average ranking by assigning a 25% weight to each metric.

To assess the rent trends in each market, we determined whether the yearly rent trend was upward, downward or neutral in each month in the quarter and then calculated an average rent trend score (between 78 and -78) for the three-month period. A score of 78, the maximum, indicates that rents grew every month in a specific market, while a score of –78, the minimum, indicates that rents declined every month.

By: IRINA LUPA