Summary: In this article, you’ll learn about 21 of the best places to buy rental property in 2022. Discover why each of these markets is a great place to invest, read housing market statistics for each area, trends to know for next 3-5 years and more.

How To Determine the Best Places To Buy Rental Property for 2022

If you’re wondering where to buy real estate in 2022, this article is for you. But before we launch into our recommendations for where to invest this year, there are a few things to note.

First, understand that the best real estate market for you may not be the best one for your neighbor or your coworker. Where you end up investing will depend largely on your personal investment goals.

In my decades of experience buying single and multi family rental properties around the United States and abroad, I’ve found that the best cities to invest in have three factors in common: job growth, population growth and affordability. When you find a market that has all three, you’ll probably be able to find good investment opportunities for both cash flow and appreciation.

There are several cities across the United States where these factors exist today — places where you can buy high cash flow rental property while prices are still low (around $150,000-$200,000 in many cases), and watch your equity grow.

In this article, you’ll learn about 21 of these best real estate markets for the year 2022. Find out what makes them great places to invest and why.

Where To Buy Real Estate: 21 Cities To Consider in 2022 (and also into 2023)

Please Note: These markets are listed in alphabetical order. Also, please make sure to always do your own due diligence when choosing a real estate market to invest in and an investment property to purchase.

#1 – Albuquerque, New Mexico

Albuquerque is a strong real estate market for 2022 because it has solid job growth, steady population growth and it’s still an affordable place to invest. The median home price is $277,530, which is 12% more affordable than the $316,368 national average. The median rent is $1,385, which offers investors an average 0.50% price-to-rent ratio.

About the Albuquerque Housing Market

Located in the middle of the Rio Grande valley, Albuquerque is the most populous city in the state of New Mexico and the 32nd-most populous city in the United States.

Albuquerque is a culturally rich and naturally beautiful metropolitan area. It’s home to most notably, the University of New Mexico, along with 10 other educational institutions.

Albuquerque’s elevation of 5,326 feet is the highest of any metropolitan area in the entire nation.

At the center of New Mexico’s “Technology Corridor,” Albuquerque has a concentration of high-tech private companies and government institutions. It is also home to Intel, Sandia National Laboratories and Kirtland Air Force Base.

In 2018, Netflix moved its U.S. production hub to the Albuquerque area. Netflix plans to expand its production site by 300 acres and agrees to spend more than $1 billion over the next decade. This expansion by Netflix is expected to produce roughly 1,000 more jobs in the coming years.

Albuquerque’s economy has been impacted by the Coronavirus pandemic, just like the rest of the country. Before the pandemic, New Mexico’s GDP growth rate was fourth-best in the nation, with rising wages. Even with a jump in job losses over the last few years, the state’s economy should bounce back relatively quickly when COVID-19 is over.

New Mexico’s property tax rates are also among the lowest in the country. Its average property tax rate is 0.78%. As such, property taxes for homeowners in New Mexico are, on average, $800 less than they are nationally. One of the biggest advantages of Albuquerque’s low property tax rate is the potential for stronger cash flow.

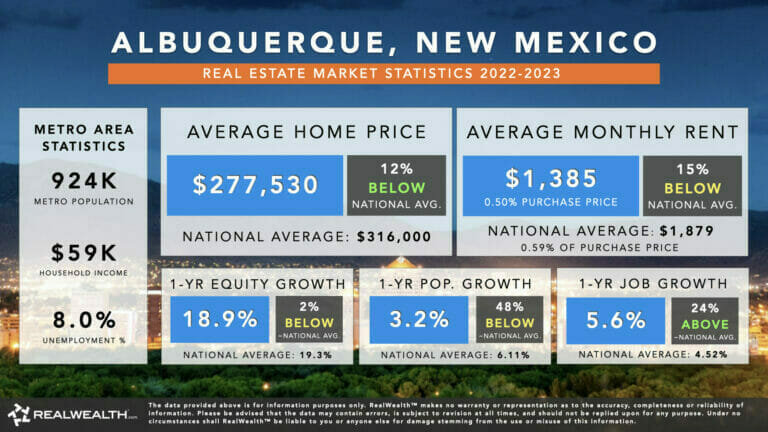

Housing Market Statistics

- Median Household Income: $72,000

- Metro Population: 923,630

- 9-Year Population Growth: 3.2%

- Albuquerque Metro Area Home Values & Rents:

- Median Home Price: $277,530

- Median Rent Per Month: $1,385 (0.50% price-to-rent ratio)

- 1-Year Equity Growth: 18.9%

- Job Growth: +20,800 CES jobs created over the last year

- 1-Year Job Growth Rate: 5.61%

- Unemployment Rate: 8%

Housing Market Quick Facts

- The median price of the average home in Albuquerque is $277,530 as of January 2022. This is 12% less than the median value nationwide.

- In 2022, the median monthly rent of all homes in the U.S. was $1,879, which is 0.59% of the median purchase price of $316,368. In Albuquerque, the median monthly rent of all homes was $1,385, which is a 0.50% price to rent ratio.

- Since 2010, the population in Albuquerque has increased by 3%. The national population grew by 6% during this period. This shows us that Albuquerque is experiencing consistent growth year after year. And although this growth isn’t staggering, it’s another indicator that Albuquerque’s real estate market will continue to be stable in years to come.

- In the last year, there were over 20,000 jobs created in the Albuquerque metro area, which equates to a 6% job growth rate for the year. This is over 24% more growth than the national average. A growing population is a strong sign that a real estate market will experience rising home values and rents in the coming years.

[Recap] Top 3 Reasons to Invest in the Albuquerque Real Estate Market in 2022

Job Growth

In the last 12 months, there were 20,800 jobs created in the Albuquerque metro area, which was a job growth rate of 6%. This was 24% higher than the national job growth rate for the year. The unemployment rate is 8%, which is on the higher side, but is likely Covid-related and will therefore adjust as the pandemic comes under control.

Population Growth

Since 2010, the population in Albuquerque has increased by 3%. Although this is less than the 6% growth experienced nationwide, this shows us that Albuquerque is experiencing consistent population growth year after year. And while this growth isn’t staggering, it’s another indicator that Albuquerque’s real estate market will continue to be stable in years to come.

Affordability

Albuquerque home values are 12% more affordable than the median value nationwide.

Data Sources:

- https://factfinder.census.gov

- https://www.deptofnumbers.com

- https://www.zillow.com

- RealWealth Property Team Data

#2 – Atlanta, Georgia

The Atlanta housing market is another one of the best places to buy rental property in 2022, because it’s still affordable and there is rapid job and population growth. In the metropolitan area, the average home price is $330,218 and the median rent is $1,875. As such, the Atlanta housing market offers investors affordable investment opportunities with the potential for impressive equity growth.

About the Atlanta Housing Market

Located in the low foothills of the Appalachian Mountains, Atlanta is the third-largest metropolitan region in the Southeast, behind the Greater Washington and South Florida areas.

For decades, the Atlanta metro area experienced rapid population growth to match the demand of new jobs being created, many of them in high-paying sectors, like manufacturing.

Today, Atlanta’s population is growing 122% faster than the rest of the nation. Since 2010, more than 730,000 people have moved to the Atlanta area, making it the fourth fastest growing metropolitan area in the U.S.

The Hartsfield-Jackson Atlanta International Airport is also the busiest airport in the world, with more than 300,000 passengers a day. The largest employers in the Atlanta metro area include Delta Air Lines (Corporate HQ/Airport), Coca-Cola, Emory University & Emory Healthcare, The Home Depot, Northside Hospital, Piedmont Healthcare, Publix Super Markets, WellStar Health System, The Kroger Co., AT&T, UPS and more. Georgia is also one of the top 10 states with the best recovery from the pandemic.

Atlanta is expected to have a strong recovery from the COVID-19 pandemic. This means there are still good opportunities to purchase rental properties that can appreciate over time, if you know where to look.

Housing Market Statistics

- Median Household Income: $72,000

- Metro Population: 6 Million

- 9-Year Population Growth: 14%

- Atlanta Metro Area Home Values & Rents:

- Median Home Price: $330,218

- Median Rent Per Month: $1,875 (0.57% price-to-rent ratio)

- 1-Year Equity Growth: 17.4%

- Job Growth: +134,700 CES jobs created over the last year

- 1-Year Job Growth Rate: 4.99% (10% higher than the national average!)

- Unemployment Rate: 2.2% (43% below the national average)

Housing Market Quick Facts

- The median home price in the Atlanta metro is just over $330,000, which is just above the national average.

- In the last year, Atlanta home values have risen by 17.4%. Although this is slightly lower than the national average of just over 19%, it’s still significant growth!

- Over the past 10 years, Atlanta’s population grew by 13.54%, which is 129% faster than the national average of 6%.

- In 2020, COVID-19 caused massive job losses nationally as well as in Atlanta. However, in the last 12 months, Atlanta has created over 134,000 new jobs, which is a growth rate of just under 5%. This is 10% more job growth than the national average, which is a good sign for investors looking to invest in an area making a strong economic comeback.

[Recap] Top 3 Reasons to Invest in the Atlanta Real Estate Market in 2022

Population Growth

Since 2010, Atlanta’s population has grown by almost 14%, which is 129% faster than the national average of 6.11%. Atlanta’s metropolitan area is also expected to have around 8.6 million residents by 2050. This is promising for investors looking to invest in an area with a large tenant pool.

Job Growth

Atlanta’s one-year job growth rate is 4.99%, which is 10% higher than the national average. This shows us that this metro area is making a strong post-covid comeback.

Affordability

As of January 2022, the median purchase price of homes in the Atlanta metro area is just over $330,000. This is 4% higher than the national average of $316,000, but still quite affordable compared to many markets across the country. RealWealth members are also able to find opportunities for around $160,000 that rent for over $1,000 per month. Plus, Atlanta has also experienced over 17% growth in home values over the last 12 months, which is a great sign for investors looking for appreciation potential.

#3 – Baltimore, Maryland

Baltimore’s real estate market is a good place to buy in 2022 because it has a strong and diverse job market, steady population growth, and affordable housing. In the Baltimore metropolitan area, the average home price is $352,000 and the median rent is $1,774. While home values in Baltimore are slightly higher than the national average, it’s possible to find newly remodeled homes for as little as $160,000, with rents around $1,500.

About the Baltimore Housing Market

Baltimore is the most populated city in the state of Maryland. It’s located about 40 miles from the nation’s capital of Washington D.C. Baltimore is a large seaport via the Chesapeake Bay, with extensive automobile shipping. The Baltimore metropolitan area has a diverse economy with major industries in health care, education, finance, and insurance. The federal government and military are also a big part of Baltimore’s workforce, with the Federal Social Security Administration headquartered in the city.

A mecca for institutions of higher education, Baltimore is home to some of the most prestigious schools in the country including Johns Hopkins University, Towson University, the University of Maryland–Baltimore, the University of Baltimore, Loyola University, the Notre Dame of Maryland University, the Maryland Institute College of Art and many more.

The city of Baltimore offers several cultural attractions, especially for art, music, theatre and history buffs. There are multiple state parks in the surrounding area and a wide variety of professional and college sports for fans to choose from.

The housing market in Baltimore is relatively affordable compared to average incomes. And even with the Coronavirus pandemic forcing a big drop in jobs, in an ordinary year, Baltimore has consistently been adding thousands of jobs. With the influx of jobs expected to restart after the pandemic ends, Baltimore should continue to grow in population, in turn increasing rental demand.

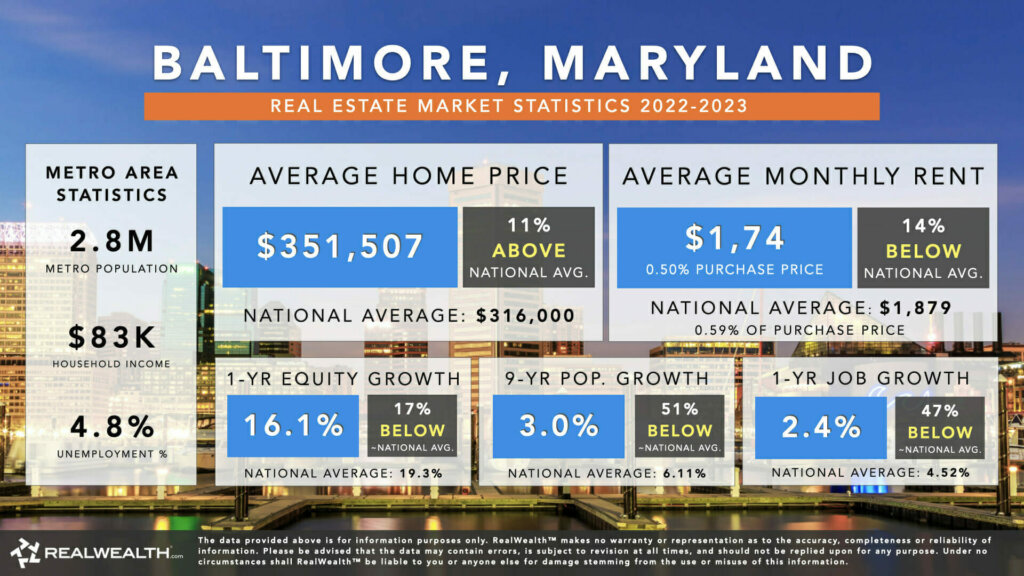

Housing Market Statistics

- Median Household Income: $83,160

- Metro Population: 2.8 Million

- 9-Year Population Growth: 3%

- Baltimore Metro Area Home Values & Rents:

- Median Home Price: $351,507

- Median Rent Per Month: $1,774 (0.50% price-to-rent ratio)

- 1-Year Equity Growth: 16.10%

- Job Growth: +32,500 CES jobs created over the last year

- 1-Year Job Growth Rate: 2.41%

- Unemployment Rate: 4.8%

Housing Market Quick Facts

- The median price of the average home in Baltimore is $352,000 in 2022. This is 11% above the median home value nationwide, but it’s still affordable compared to many markets around the country.

- The median monthly rent of homes in Baltimore is $1,774, which is a 0.50% price-to-rent ratio.

- Since 2010, the population in Baltimore has increased by 3%, which is 49% slower than the national average of 6.11%. This shows us that Baltimore is experiencing slower, but steady population growth year after year.

- Baltimore’s job growth rate over the last year was 2.41%, which is 47% below the national average.

[Recap] Top 3 Reasons to Invest in the Baltimore Real Estate Market in 2022

As mentioned, many of the strongest real estate investment markets have three factors in common: job growth, population growth and affordability. Baltimore has all of these factors and more.

Job Growth

In the past year, the Baltimore metropolitan area created 32,500 CES jobs. This is a job growth rate of 2.41%.

Population Growth

Since 2010, the population in Baltimore has increased by 3%. While this is 49% slower than the rest of the nation, it’s an indicator that Baltimore’s real estate market is stable and that the demand for rental housing should increase as people continue moving to the area. This is good news for buy-and-hold investors looking for stable equity growth potential.

Affordability

Baltimore metro home values are 11% above the median home value nationwide, however it is possible to find remodeled homes for as little as $160,000 that will rent for around $1,500 per month.

#4 – Birmingham, Alabama

Birmingham, Alabama is another one of the best places to invest in rental property in 2022 because the area is uniquely affordable, its population has been steadily increasing and jobs are abundant. The average home price in the Birmingham metro is just $216,000 and the median rent is $1,312, which is a 0.61% price-to-rent ratio. It’s also still possible to find great investment properties in certain neighborhoods for around $135,000 that’ll rent for over $1,000 per month. If you’re looking for an affordable real estate investment in 2022, keep reading.

About the Birmingham Housing Market

Located in the foothills of the Appalachian Mountains, Birmingham is the most-populous city in the state of Alabama and the county seat of Jefferson County. More than 1.2 million people call Birmingham home and it’s population is slowly, but steadily increasing. In fact, Millennials are one of the large demographics moving to the Birmingham area.

At the height of the nation’s manufacturing age, the city grew so fast in population it was nicknamed the “Magic City.” The nickname stuck when they discovered it was also the only city in the world where the three raw ingredients used to make steel (coal, limestone, and iron ore) occur naturally in a ten-mile radius.

Just minutes from downtown Birmingham, you’ll find thousands of acres of tree-filled greenspace, great for hiking and biking. Barber Motorsports Park is one of the nicest racing facilities in the world and is the host to the Honda Indy Grand Prix–the only city in the deep south on the North American Indy circuit.

What makes it one of the best places to buy real estate in 2022? Well, in the last few decades, Birmingham has undergone a major revitalization, becoming a hub for publishing, medical research, banking, construction, technology, entrepreneurs and service-based companies. In fact, the Birmingham metro has the highest per capita concentration of healthcare workers nationwide.

Today, the Magic City is considered one of the nation’s most livable cities because of its vibrant downtown, burgeoning loft community, and world-class culinary scene.

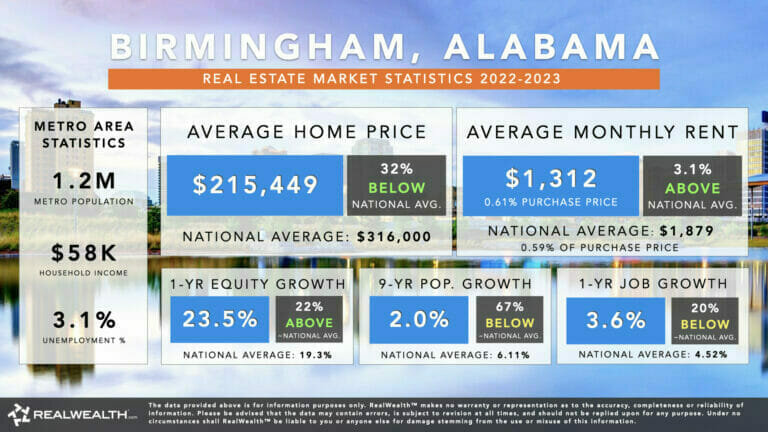

Housing Market Statistics

- Median Household Income: $58,366

- Metro Population: 1.2 Million

- 9-Year Population Growth: 2%

- Birmingham Metro Area Home Values & Rents:

- Median Home Price: $215,449

- Median Rent Per Month: $1,312

- 1-Year Equity Growth: 23.5%

- Job Growth: +19,800 CES jobs created over the last year

- 1-Year Job Growth Rate: 3.63%

- Unemployment Rate: 3.10% (21% below the national average)

Housing Market Quick Facts

- Birmingham is an affordable place to invest in real estate in 2022. The average home prices in the metro area is $216,000 which is 32% more affordable than the national average.

- Birmingham offers a cash flow opportunity. The average price-to-rent ratio for all homes across the metro area is 0.61%, but in some neighborhoods you can secure rent for more than 0.92% of the purchase price.

- In the last 12 months, home values in the Birmingham metro area have risen by 24%, which is 22% higher than the national average.

- Birmingham is growing steadily. Over the last 6 years, Birmingham has experienced both population and job growth at a slow, but steady rate.

[Recap] Top 3 Reasons to Invest in the Birmingham Real Estate Market in 2022

As mentioned throughout this article, job growth, population growth and affordability are three of the most important factors to consider when analyzing a real estate market. Here’s how Birmingham stacks up:

Job Growth

In the last 12-months, Birmingham created almost 20,000 new jobs, which was a growth rate of just under 4%. Although this is below the national average, growth is still a good sign for investors… especially for those looking for a more stable place to invest.

Population Growth

Since 2010, Birmingham’s population has grown by 2.70%. Although this is slower than the national average, it does show consistent growth. This is a good sign of stability in a strong real estate market.

Affordability

Birmingham home values are 32% below the national average. Alabama is also one of the states with the lowest property tax rates in the nation. Both of these factors combined make Birmingham a strong market for cash flow investors.

#5 – Charlotte, North Carolina

The Charlotte housing market is one of the most exciting markets for 2022. Its population is growing incredibly fast because the job market continues to expand and housing is very affordable. In the Charlotte metro area, the median home price is $329,961 and the average rent is $1,693. Investors looking for solid equity growth should keep reading to learn more about the opportunities Charlotte has to offer.

About the Charlotte Housing Market

North Carolina is one of the most visited states in the nation. Its landscape is diverse, ranging from beautiful beaches along the Atlantic Ocean to the Great Smoky Mountains.

Charlotte, the largest and fastest-growing city in North Carolina, has a metro population of 2 million. In recent years, there’s been an uptick of Millennials moving to this area. The major reasons young professionals are attracted to Charlotte are because it’s affordable, has job opportunities, is tax-friendly, and has a huge single population.

Charlotte has a diverse economy with key industries in finance, health care and technology. Some of the biggest companies in the Charlotte area are Bank of America, Wells Fargo, Lowe’s Brighthouse Financial, Atrium Health and Duke Energy.

Charlotte’s rapidly growing population, affordability and job growth has brought huge demand for affordable housing, making Charlotte’s real estate market one of the more exciting in the country today.

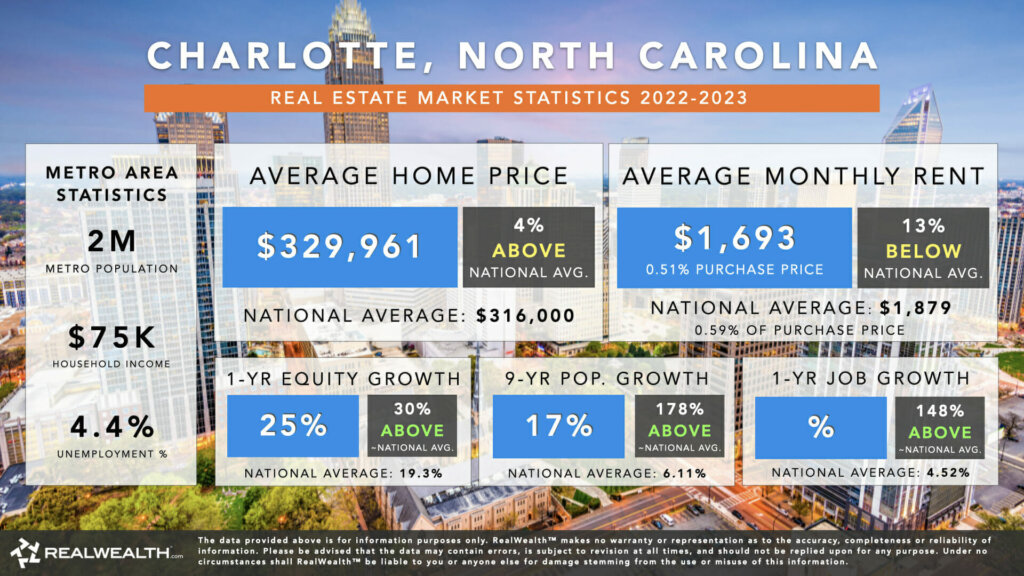

Housing Market Statistics

- Median Household Income: $66,000

- Metro Population: 2 Million

- 9-Year Population Growth: 17%

- Charlotte Metro Area Home Values & Rents:

- Median Home Price: $329,961

- Median Rent Per Month: $1,693 (0.51% price-to-rent ratio)

- 1-Year Equity Growth: 25%

- Job Growth: +140,500 CES jobs created over the last year

- 1-Year Job Growth Rate: 3.18%

- Unemployment Rate: 4.14%

Housing Market Quick Facts

- The median price of the average home in Charlotte is $329,961 in 2022. This is 12% less than the median home value nationwide.

- The median monthly rent of an average home in Charlotte was $1,693, which is 0.51% of the purchase price.

- Since 2010, the population in Charlotte has increased by 17%, which is 178% faster than the national average of 6%. This shows us that Charlotte is experiencing lots of growth year after year, which is another indicator that Charlotte’s real estate market will continue to grow in the coming years.

- In the last year, Charlotte created 140,500 jobs, which is a job growth rate of 3.18%.

[Recap] Top 3 Reasons to Invest in the Charlotte Real Estate Market in 2022

Charlotte has job growth, population and growth and affordability, all of which make it a strong place to invest in real estate in 2022 and beyond.

Population Growth

Since 2010, the population in Charlotte has increased by 17%, which is 178% faster than the national average. This type of rapid population growth is an indicator that Charlotte offers strong real estate investment opportunities.

Affordability

Charlotte’s home values are 12% more affordable than the median home value nationwide. In the neighborhoods where RealWealth members invest, it’s possible to find even more affordable properties – some for around $250,000 that will rent for $1,700 a month.

Job Growth

Over the last year, Charlotte’s job growth rate was 3.18%. This is lower than the national average, but it’s still a sign of growth. There’s also new expansion on the way as companies (and people, as seen above) migrate to Charlotte and bring jobs. The Centene Corporation, as an example, plans to invest over $1 Billion in Charlotte and bring over 6,000 jobs.

#6 – Chicago, Illinois

Chicago is another one of the top cities to invest in rentals in 2022, because as one of the biggest cities in the U.S., it’s densely populated, has a huge job market and still offers relatively affordable prices. The average home in the Chicago metro costs $287,000 and median rent is $1,730. However, there are pockets around Chicago where even more affordable homes can be found with comparable rents. Keep reading to find out why investors are taking a hard look at the Chicago real estate market in 2022.

About the Chicago Housing Market

Known for its towering skyscrapers and Fortune 500 companies, the Windy City is one of the few remaining U.S. markets where you can still find great investment opportunities.

One of the most notable characteristics of Chicago’s economy is that it is extremely diversified, making it incredibly balanced and stable. Major industries in Chicago include leisure and hospitality, tourism, and private sector companies.

With lower-than-average job and population growth, Chicago may not seem like a “good” place to invest in real estate. That said, it is one of the few cities in the nation where housing prices still haven’t risen above their 2006 levels.

When focusing on finding the highest capital growth and cash flow, you’ll find some neighborhoods around Chicago offer homes for around $220,000, with rents as high as 1.23% of the purchase price every month! This is significantly above the national average when it comes to price-to-rent ratio! To make matters even better, nearly half of Chicagoans are renters, resulting in a high rental demand.

All of this is good news for investors looking for below market value properties, with tremendous potential for monthly cash flow and steady appreciation.

Housing Market Statistics

- Median Household Income: $75,000

- Metro Population: 9.5 Million

- 9-Year Population Growth: -0.1%

- Chicago Metro Area Home Values & Rents:

- Median Home Price: $287,131

- Median Rent Per Month: $1,730 (0.60% price-to-rent ratio)

- 1-Year Equity Growth: 8.6%

- Job Growth: +162,700 CES jobs created over the last year

- 1-Year Job Growth Rate: 3.72%

- Unemployment Rate: 5%

Housing Market Quick Facts

- Chicago is the 3rd largest city in the United States and among the top 5 most economically powerful cities in the world.

- The median sale price of the average home in the Chicago metro area is $287,000 in 2022, which is 9% less than the national average.

- Chicago created 162,700 new jobs in the last 12 months, which is a job growth rate of 3.72%.

- Chicago is home to 30 Fortune 500 companies and boasts a $697 billion GDP, which is more than that of Norway and Belgium combined!

[Recap] Top 3 Reasons to Invest in the Chicago Real Estate Market in 2022

Affordability

Chicago is one of the last markets where housing prices have not yet risen past their 2006 levels, simply due to the state’s tough foreclosure laws. The median sale price for a home in Chicago is $287,000, but it’s possible to find homes for sale in mid-level neighborhoods for even less.

Job Growth

Chicago is the 3rd largest city in the United States and among the top 5 most economically powerful cities in the world. There are 30 Fortune 500 companies headquartered in the metro area, which boast a $697 billion GDP. In the past year, Chicago created 162,700 new jobs, which is a job growth rate of 3.72%. Although this growth doesn’t beat the national average, this market is primed for consistent growth year over year.

Population Growth

Real estate prices have soared within Chicago’s city limits, causing people to move out of the city and into the suburbs. As a result, prices in many of these neighborhoods continue to increase. While Chicago’s population is not growing, there are still some Chicago suburbs that are growing and still make for a strong investment.

#7 – Cincinnati, Ohio

The Cincinnati metro offers a great opportunity for real estate investors in 2022. The housing market in this metro area is affordable, with average home values of $239,000 and median rents of $1,362. While the area isn’t experiencing tons of population growth and job growth, people are continuing to move to the area at a steady rate and new jobs are being created every year. Learn more about Cincinnati’s housing market in 2022 below.

About the Cincinnati Housing Market

Cincinnati is a unique and historic city located on the Ohio River. Winston Churchill once said that “Cincinnati is the most beautiful of the inland cities of the union.” It seems like a lot of people today agree with Mr. Churchill. This is one reason why Cincinnati is considered one of the best places to buy rental property in 2022.

With a population of 2.2 million, Cincinnati is part of the 24th largest U.S. metropolitan area and it’s growing fast! Over the last few years, Cincinnati has attracted a large population of millennials, which continues to rapidly grow.

Cincinnati has also become a popular destination for new and relocating corporate headquarters, including 10 Fortune 500 companies and 17 Fortune 1000 companies.

According to the Brookings Institution, the Cincinnati and Dayton (more details on Dayton below) areas are among the nations 25 fastest developing regions. Yet the cost of living and the cost of housing are still well below the national average, making this an affordable and attractive place to live. In 2022, the median monthly rent for an average home in Cincinnati was $1,362, which is 0.57% of the purchase price of $238,813. This is just under the national price-to-rent ratio of 0.59%.

Within certain neighborhoods around the Cincinnati metro area, you can find move-in-ready investment properties for as little as $125,000 that’ll rent for $1,195 or 0.96% of the purchase price.

All of these are good signs for investors that are looking to invest in cash flowing rental property with a chance of steady appreciation. This is why Cincinnati has made our list of best cities to buy real estate in 2022.

Housing Market Statistics

- Median Household Income: $67,000

- Metro Population: 2.2 Million

- 9-Year Population Growth: 3.8%

- Cincinnati Metro Area Home Values & Rents:

- Median Home Price: $238,813

- Median Rent Per Month: $1,362 (0.57% price-to-rent ratio)

- 1-Year Equity Growth: 17%

- Job Growth: +37,600 CES jobs created over the last year

- 1-Year Job Growth Rate: 3.55%

- Unemployment Rate: 3.9%

Housing Market Quick Facts

- Cincinnati is among the nation’s 25 fastest developing regions with a steadily growing population. It’s also the country’s 4th largest inland hub.

- The area is 4th in the U.S. in terms of new facilities – including GE Aviation’s new 420,000 square-foot Class A office campus and a new 80,000 sq ft Proton Therapy Center for cancer research.

- In 2022, the median monthly rent for an average home in Cincinnati was $1,362, which is 0.57% of the purchase price of $238,813. This is just below the national price-to-rent ratio of 0.59%.

- In the neighborhoods where RealWealth members invest, it’s possible to purchase rental properties for as little as $125,000 that can rent for about $1,195 per month, or 0.96% of the purchase price.

[Recap] Top 3 Reasons to Invest in the Cincinnati Real Estate Market in 2022

Affordability

The average home in Cincinnati costs $239,000, which is 25% more affordable than the national average. However, in some neighborhoods it’s possible to find investment properties that are as much as 60% less than the national average and rent them for just under 1% of the purchase price.

Job Growth

The Cincinnati metro area has the 4th largest number of new facilities in the U.S. – including GE Aviation’s new 420,000 square-foot Class A office campus and a new 80,000 sq ft Proton Therapy Center for cancer research. In the past year, Cincinnati has created 37,600 CES jobs, which is a job growth rate of 3.55%.

Population Growth

The Cincinnati metro population has grown 3.76% over the past nine years. Although this is below the national average, any growth is still a good sign. Plus, with a cost of living that is well below the national average, this trend will likely continue in 2022.

#8 – Cleveland, Ohio

Cleveland is another one of the best real estate markets for 2022 for a number of reasons. For starters, although the overall population has been slowly declining, the area is experiencing an increase in its Millennial and Gen Z populations who are moving to the area because it’s affordable, there’s a bustling downtown community and there are jobs (this trend has even picked up during the pandemic). This is significant, because a large majority of young people prefer to rent (or can’t afford to buy). The median metro home price in Cleveland is just under $200,000 and average rent is $1,278. However, there are pockets around Cleveland where you can find even lower priced homes with higher rents. Check out the reasons why we like Cleveland’s real estate market in 2022 below.

About the Cleveland Housing Market

Cleveland, Ohio is one of the strongest real estate markets in the nation, offering investors higher than average cash flow and future growth. With a workforce of over 2 million people, Cleveland is the 12th largest economic region in the nation. Cleveland is located on the southern shore of Lake Erie, about 60 miles west of the Pennsylvania border.

Although Cleveland’s overall population isn’t growing rapidly, there are a huge number of people moving downtown, mostly comprised of the coveted Millennials and Gen Z (ages 18-34). This demographic shift is referred to as the “brain gain,” since there’s been a 139% rise in the number of young Cleveland residents with bachelor’s degrees.

Why? Downtown Cleveland has experienced a renaissance over the past several years, with an estimated $19 billion in development completed or planned since 2010. Just in the last few years, a 10-acre green space downtown was redesigned and has quickly become a gathering place for locals and tourists. The $50-million redesign is just one of many commercial and residential real estate developments.

The job market in the Cleveland metropolitan area is also strong. It offers a variety of jobs in industries such as IT, manufacturing and healthcare. These high-paying positions are plentiful, yet there still aren’t enough qualified professionals to take these jobs, which is one of the reasons for so much population growth among younger demographics.

What’s especially significant about this trend is that most young people are renters. This means there is a strong rental demand in the area, which is a good sign for investors.

Housing Market Statistics

- Median Household Income: $57,000

- Metro Population: 2.1 Million

- 9-Year Population Growth: -1.3%

- Cleveland Metro Area Home Values & Rents:

- Median Home Price: $199,727

- Median Rent Per Month: $1,278 (0.64% price-to-rent ratio)

- 1-Year Equity Growth: 24%

- Job Growth: +15400 CES jobs created over the last year

- 1-Year Job Growth Rate: 1.53%

- Unemployment Rate: 3.7%

Housing Market Quick Facts

- Cleveland has one of the fastest growing healthcare economies in the U.S. (and is home to world renowned Cleveland Clinic).

- Cleveland is the nation’s first Global Center for Health and Innovation as well as a new medical convention center.

- 10 Fortune 500 companies are headquartered in Cleveland, including Goodyear Tire, Cliffs, Natural Resources, Firstenergy, Sherwin Williams, Eaton Corporation, TravelCenters of America, Aleris, Parker Hannifin, Progressive Insurance, KeyCorp.

- Cleveland is home to three major sport teams that bring billions of dollars of revenue to the area every year.

- In 2022, the median price of homes in Cleveland was $199,727. This is 37% lower than the national average.

[Recap] Top 3 Reasons to Invest in the Cleveland Real Estate Market in 2022

Here’s a recap of the top three factors that make Cleveland one of the best cities to buy rental property in for 2022:

Affordability

The median home price in Cleveland is only $200,000 in 2022, which is 37% lower than the national average. In some neighborhoods, it’s possible to find investment properties for as little as $109,900 that will rent for $1,150 per month, which is over 1% of the purchase price. This means there’s a good opportunity for cash flow in this market. And that’s great news for real estate investors in 2022.

Job Growth

Cleveland has the fast-growing healthcare and tech sector. Millennials and Gen Z are moving into the area at a rapid pace to take advantage of the revitalized downtown community and job opportunities available, including those at The Cleveland Clinic, Eaton Corporation, and Key Corp.

Population Growth

While Cleveland’s population has declined over the last 9 years, the number of people moving to downtown Cleveland has increased over 102% since 2000. And the pace is picking up, with more people moving downtown in the last few years. The population growth is mostly made up of the Millennials and Gen Z.

#9 – Dallas, Texas

The housing market in the Dallas metro area is another one of the strongest places to invest in 2022. What makes Dallas so appealing for investors is it’s rapid population and job growth, coupled with its relative affordability. In 2022, the average price of a home in the Dallas area is $338,000 and median rent is $1,696. However, you can still find great investment properties in certain parts of the Dallas metro, at even lower prices with comparable rents. Learn more about Dallas below.

About the Dallas Housing Market

Located in Northern Texas, Dallas is the fourth most populous metropolitan area in the nation. Historically, Dallas was one of the most important centers for the oil and cotton industries due to its strategic position along numerous railroad lines.

In the last several years, companies from cities like San Francisco and Los Angeles have started exploring the nation to find the best cities for relocation. Many of them have targeted Dallas as a prime spot for their HQs. There are a variety of reasons for this, including Texas’ business-friendly environment (ie: lower cost of doing business, lower taxes, and fewer business regulations). Dallas also offers a lower cost of living for employees, which means companies can offer lower salaries without their employees needing to sacrifice their lifestyles.

The leading industries within the Dallas metro area include technology, financial services and defense. The Fort Worth area is also a part of the Dallas metro, and has major industries in oil and gas, manufacturing, and aviation/aerospace. The Dallas-Fort Worth metro is home to roughly 43% of all Texans working in the high-tech industry.

The largest employers in the region include American Airlines, Dallas ISD, Texas Health Resources, Bank of America, Baylor Scott & White, and Lockheed Martin Aeronautics.

The city of Dallas attracts a diverse population of people with its dense concentration of restaurants and shopping centers, as well as rich culture and extensive art scene. Dallas is also known for its popular sports teams. The NFL’s Dallas Cowboys, NBA’s Dallas Mavericks, MLB’s Texas Rangers, the NHL’s Dallas Stars, MLS’s FC Dallas, and the WNBA’s Dallas Wings. There’s also a major following of college sports fans located around the area.

The good news for real estate investors is that even with a population rising incredibly fast, the area still remains relatively affordable. The average home price in the Dallas metro is $238,000, which is just 7% above the national average.

We especially like real estate around Dallas because it’s still possible to find less expensive, newly-remodeled homes for around $160,000 that can rent for about $1,250. Some RealWealth members have even been able to purchase duplexes for around $300,000 that rent for as much as $2,725 per month.

This means that in certain neighborhoods, investors can secure upwards of a 0.91% price-to-rent ratio, which is well above the national average of 0.59%. Not to mention the 20% equity growth Dallas homes have experienced over the last year, which is 4% faster than the national average. These indicators show us that there are opportunities for both cash flow and appreciation for Dallas real estate investors.

Housing Market Statistics

- Median Household Income: $72,000

- Metro Population: 7.5 Million

- 9-Year Population Growth: 18.5%

- Dallas Metro Area Home Values & Rents:

- Median Home Price: $338,194

- Median Rent Per Month: $1,696 (0.50% price-to-rent ratio)

- 1-Year Equity Growth: 20%

- Job Growth: +196,500 CES jobs created over the last year

- 1-Year Job Growth Rate: 5.30%

- Unemployment Rate: 4.70%

Housing Market Quick Facts

- In 2022, the median purchase price of homes in the Dallas metro area is $338,194. This is 7% above than the national average. However, in some neighborhoods, it’s possible to purchase single family homes for as little as $160,000, which is 49% below the national average.

- Dallas offers investors an opportunity to generate passive monthly income. The median monthly rent for homes in Dallas is $1,696, which is 0.50% of the purchase price. This is slightly below the national average of 0.59%. However, in some neighborhoods, it’s possible to secure rents that are 0.91% of the purchase price and above.

- Dallas home values are rising faster than other real estate markets. In the last year, the average home in Dallas has appreciated by 20% compared to 19% nationally.

- Dallas is the ninth most populous city in the U.S. and is a huge commercial and cultural hub in Texas. This is likely why the population is growing so rapidly–the area experienced an 18% jump in population between the 2010 and 2019 censuses, which is a whopping 202% faster than the national average.

[Recap] Top 3 Reasons to Invest in the Dallas Real Estate Market in 2022

Population Growth

Dallas’ population is growing rapidly. The population in Dallas has increased by 18.48% over the past 9 years, which is 202% faster than the national average. This shows us that people are moving to Dallas at a higher rate than most other cities across the nation today.

Affordability

Although across the board, Dallas homes are slightly more expensive than the national average, in the neighborhoods where RealWealth members invest, it’s possible to find newly-remodeled single family homes for as little as $160,000. This is 49% more affordable than the national average. It’s also possible to purchase duplexes in the Dallas metro for $300,000-330,000 that’ll rent for 0.8-0.9% of the purchase price each month. Bonus: Over the past year, homes in Dallas have appreciated 20%, which is higher than the national average. This shows us that home values and monthly rents are rising more quickly than the majority of cities across the U.S.

Job Growth

In the past year, Dallas created 196,500, which is an annual job growth rate of 5.30%. This is 17% above the national average.

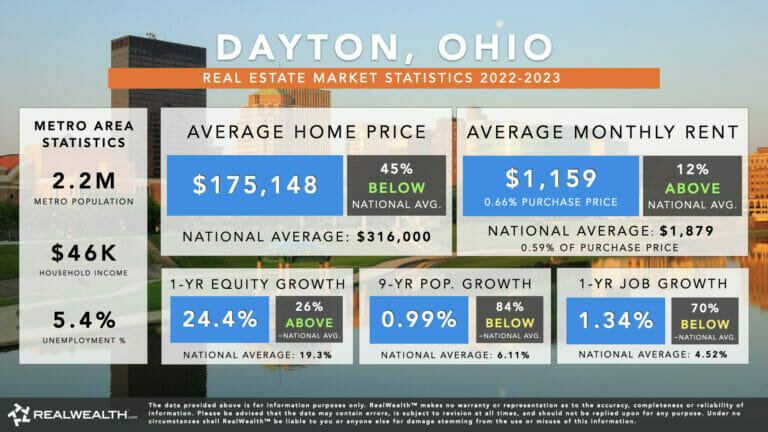

#10 – Dayton, Ohio

The housing market in Dayton is similar to Cincinnati due to their close proximity to each other. The median home price in Dayton is $175,148 and the average rent is $1,159. Dayton is extremely affordable and presents a great opportunity for cash flow real estate investors. It’s actually possible to find rental properties for under $150,000 that have price-to-rent ratios of 1%, which is 66% above the national average. See what else Dayton’s housing market has to offer investors in 2022 below.

About the Dayton Housing Market

The city of Dayton is located between Columbus and Cincinnati and has nearly 140,000 residents. These areas are both experiencing growth due to a rush of housing, retail and commercial development across Warren and Butler counties.

One significant investor benefit of this area is that the majority of people living in Dayton rent their homes. Much like Cincinnati, Dayton has also been attracting a large population of young people because it’s diverse and has a great nightlife scene.

As Dayton is a smaller city than Cincinnati and Columbus, it has even more affordable housing. The average home in the Dayton area costs $175,000, which is well below the national average. The median rent is $1,159 or an average 0.66% price to rent ratio, which is well above the national average.

In certain areas around Dayton, there are homes available for around $126,000 with rents as high as $1,200! This means that the price-to-rent ratio can be as high as 0.95% for homes in the Dayton area, which is 66% higher than the 0.59% national average. As such, Dayton is another place where investors can buy affordable and cash-flowing rental property.

Housing Market Statistics

- Median Household Income: $46,430

- Metro Population: 2.2 Million

- 9-Year Population Growth: 0.99%

- Dayton Metro Area Home Values & Rents:

- Median Home Price: $175,148

- Median Rent Per Month: $1,159 (0.66% price-to-rent ratio)

- 1-Year Equity Growth: 24.4%

- Job Growth: +5,000 CES jobs created over the last year

- 1-Year Job Growth Rate: 1.34%

- Unemployment Rate: 5.4%

Housing Market Quick Facts

- The Dayton housing market is among the nation’s 25 fastest developing regions with a growing population every year.

- A $350 million retail complex opened in 2018.

- Dayton is a part of the country’s 4th largest inland hub, including Cincinnati and Columbus.

- The metro’s largest employers include Wright-Patterson Air Force Base, Premier Health, Kettering Health Network and Kroger Co.

- In 2022, the median monthly rent for an average home in Dayton was $1,159, which is 0.66% of the purchase price of $175,148. This is 12% above the national price-to-rent ratio of 0.59%.

- In the last year, home values in the Dayton metro have appreciated by over 24%. This is 26% faster than the national average and is a great sign for buy and hold investors looking for appreciation.

- In the neighborhoods where RealWealth members invest, it’s possible to purchase homes for as little as $126,000 with rents as high as $1,200! This means that the price-to-rent ratio can be as high as 0.95% for homes in the Dayton area, which is 66% higher than the national average. As such, cash flow investors should consider taking a closer look at buying real estate in Dayton.

[Recap] Top 3 Reasons to Invest in the Dayton Real Estate Market in 2022

Affordability

In Dayton, it’s still possible to purchase fully renovated cash flow properties in good neighborhoods for an average $175,148, which is 45% below the average price of homes nationwide. The price-to-rent ratio is also almost 1% in some neighborhoods, which is way above the national average of 0.59%.

Job Growth

The Dayton metro area has created 5,000 jobs in the last 12 months for a growth rate of 1.34%. Although this is significantly lower than the national average, there are promising signs that Dayton’s population will continue growing in the coming years due to its affordability.

Population Growth

The Dayton metro population has only grown 0.99% over the past nine years. Although this is well below the national average, it’s still growth. And with a cost of living that is below the national average, this trend will likely continue.

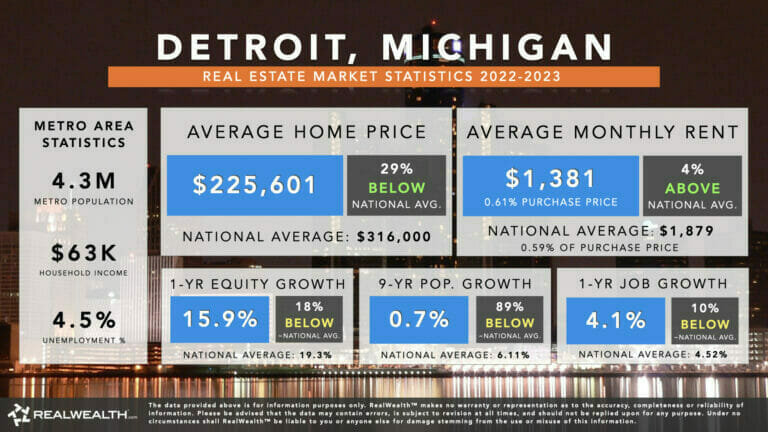

#11 – Detroit, Michigan

Detroit is another one of the best places to invest in rental properties this year, because of its affordability and strong price to rent ratio in many neighborhoods. In the Detroit metro area, you can expect median home prices of $225,000 and average rents are $1,381. Although the population growth is slower than the national average, people are still moving here at a steady rate, which is a good sign for investors looking for a very affordable and stable real estate market. The job market in Detroit has lost more jobs than most cities around the country due to the COVID-19 pandemic. However, jobs have already started to recover and are expected to grow in 2022.

About the Detroit Housing Market

Detroit is the largest city in the state of Michigan AND it’s recognized as the automotive capital of the world. Nicknamed the “Motor City,” the Detroit metro area is home to General Motors, Ford Motor Company, and Chrysler. “The Big 3” major automotive companies in the U.S. and Canada, offer a wide range of jobs and invest billions of dollars into the city’s infrastructure.

Detroit is also home to 100 Fortune 500 companies, including Penske Automotive, Quicken Loans, Kellogg, Whirlpool, and Walmart.

Despite its longstanding nickname, several of Detroit’s fastest-growing industries are in sectors as diverse as healthcare, defense, aerospace, IT and logistics.

Billionaire Dan Gilbert (the chairman and founder of Rock Ventures and Quicken Loans Inc, as well as the majority owner of the National Basketball Association’s Cleveland Cavaliers, the American Hockey League’s Cleveland Monsters, the Arena Football League’s Cleveland Gladiators and the NBA Development League’s Canton Charge) has moved numerous companies to Detroit, investing over $1.6 Billion in the Detroit area. Major attractions include Detroit Tigers, Detroit Lions, Detroit Red Wings, Wayne State University, University of Michigan, Beaumont Hospital, and Fox Theater.

Downtown Detroit is also being totally revitalized with billions of dollars of real estate and

construction activity underway. Plus, many of the dilapidated foreclosures have been torn down.

Construction on the Gordie Howe International Bridge began in 2018, which will span the Detroit River and connect to Windsor, Ontario, Canada. The bridge is scheduled to be completed by 2024 and will provide a toll-free option for travelers.

Detroit has experienced barely any growth in population since 2010 and the area is not creating jobs at a higher rate than the national average. However, the area is already home to over 300,000 businesses, which includes 11 Fortune 500 companies and several Universities. As such, the area has the “talent, resources and cutting-edge facilities to drive innovation,” according to the Detroit Chamber. Also, like Cleveland, the area is experiencing an increase in the number of millennials moving to the area, likely to take advantage of the very low cost of living. This is a good sign for investors, because millennials often rent instead of buying.

For these reasons, we believe Detroit is one of the best places to invest in rental properties for cash flow in 2022.

Housing Market Statistics

- Median Household Income: $63,474

- Metro Population: 4.3 Million

- 9-Year Population Growth: 0.7%

- Detroit Metro Area Home Values & Rents:

- Median Home Price: $225,601

- Median Rent Per Month: $1,381 (0.61% price-to-rent ratio)

- 1-Year Equity Growth: 15.9%

- Job Growth: +76,900 CES jobs created over the last year

- 1-Year Job Growth Rate: 4.08%

- Unemployment Rate: 4.5%

Housing Market Quick Facts

- Detroit is also home to 100 Fortune 500 companies, including Penske Automotive, Quicken Loans, Kellogg, Whirlpool, and Walmart.

- Despite its longstanding nickname, several of Detroit’s fastest-growing industries are in sectors as diverse as healthcare, defense, aerospace, IT and logistics.

- The Michigan Business Development Program provides grants, loans, and other economic assistance to businesses.

- Michigan has a flat 6% corporate income tax, which is the lowest in the nation.

- Personal income tax is also among the lowest in the nation at 1.2%.

- Michigan also has a lower cost of living than any other Midwestern state.

- Since 2010, more than 45,000 automotive manufacturing jobs have been added to the Detroit Metro, which is more than any other area in the nation.

- Detroit is still an affordable place to invest in real estate with an average home value of just $225,000.

[Recap] Top 3 Reasons to Invest in the Detroit Real Estate Market in 2022

Affordability

The median home value in the Detroit metro is only $225,000 in the year 2022. This is almost 30% below the national average. The median rent is $1,381, which offers investors a stronger price to rent ratio than the national average. This is what makes the Detroit metropolitan area a great market for cash flow investors in 2022.

Job Growth

Detroit created just under 77,000 jobs in the last 12 months, which is an annual job growth rate of just over 4%. Although this is lower than the national average, the Detroit metro outperforms similar markets at attracting educated Millennials (many who are renters) to their workforce. This is likely due to the affordable cost of living and several research universities in the area, including Wayne State University.

Population Growth

People have been following companies and jobs to “less expensive” cities like Detroit over the last several years. It makes sense that companies would want to move to Michigan, because the state’s corporate income tax rate is the lowest in the country. For example, Billionaire Dan Gilbert has moved numerous companies to Detroit, investing over $1.6 Billion in the Detroit area.

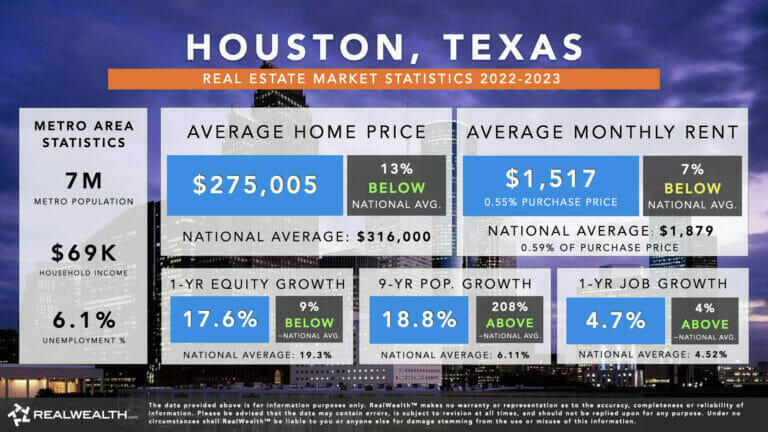

#12 – Houston, Texas

The Houston housing market is another strong real estate market for 2022 because of its diverse job market and rapidly growing population, along with its continual affordability. The average home in the Houston area costs $275,000 and the median rent is $1,517. Find out more below about the real estate investment opportunities in the Houston area below.

About the Houston Housing Market

When then-President of the Republic of Texas, Sam Houston, incorporated the City of Houston in 1837, the prevailing industry was railroad construction, oil and gas. A lot has changed since then, but the city’s passion for modes of transportation has not. Houston is the home of NASA’s Mission Control and also the busiest seaport in the U.S. in terms of foreign tonnage.

Today, Houston is now the fourth-largest city in the U.S. and includes 11-counties within Texas.

Houston has a diverse economy and growing industries in healthcare, digital technology, trade and manufacturing. In fact, about 33% of manufacturers in the state of Texas are located in the Houston area.

What makes this city one of the best places to buy rental property in 2022? It has job growth, tremendous population growth, AND it’s still pretty darn affordable!

Houston is home to 49 Fortune 1000 companies, which is the second largest concentration of any other city in the country, behind only New York with 72. In addition, the largest medical center in the world, The Texas Medical Center, is located in Houston and gets an average of 7.2 million visitors per year. To date, there have been more heart surgeries performed here than anywhere else in the world.

All in all, Houston is a stable, landlord-friendly market that offers both cash flow and equity growth. And you can STILL acquire properties well below their replacement value.

Housing Market Statistics

- Median Household Income: $69,193

- Metro Population: 7 Million

- 9-Year Population Growth: 18.8%

- Houston Metro Area Home Values & Rents:

- Median Home Price: $275,005

- Median Rent Per Month: $1,517 (0.55% price-to-rent ratio)

- 1-Year Equity Growth: 17.6%

- Job Growth: +138,800 CES jobs created over the last year

- 1-Year Job Growth Rate: 4.68%

- Unemployment Rate: 6%

Housing Market Quick Facts

- Houston’s population is growing rapidly – since 2010 there has been a 19% increase in the metro population, which is 208% faster growth than the national average.

- Houston is more affordable than many U.S. real estate markets today. In 2022, the median price of homes in Houston was $275,000. This is 13% lower than the national average.

- Houston is creating jobs at a faster rate than the national average. To be exact, the metro area has added 138,800 CES jobs over the last year, which is a growth rate of just under 5%. This is 4% above the national average.

- Houston was ranked the #10 best city for young entrepreneurs by Forbes and #2 for best places to live in the world by Business Insider.

[Recap] Top 3 Reasons to Invest in the Houston Real Estate Market in 2022

Population Growth

Since 2010, Houston’s population has increased by 18.81%. During the same period, the national population grew by only 6%. This means that the population in Houston is growing 208% faster than the national average. This shows us that people are moving to Houston in greater numbers than the majority of other American cities. Another positive indicator of a strong housing market.

Affordability

In 2022, the median price of homes in Houston was $275,000. This is 13% lower than the national average. This makes it a strong place to buy for investors interested in finding an affordable investment with appreciation potential.

Job Growth

Houston created 138,800 CES jobs over the last 12 months, which is an annual growth rate of just under 5%. This is quite a bit higher than the national average, which is a strong indication for investors looking to buy in a market with abundant job opportunities.

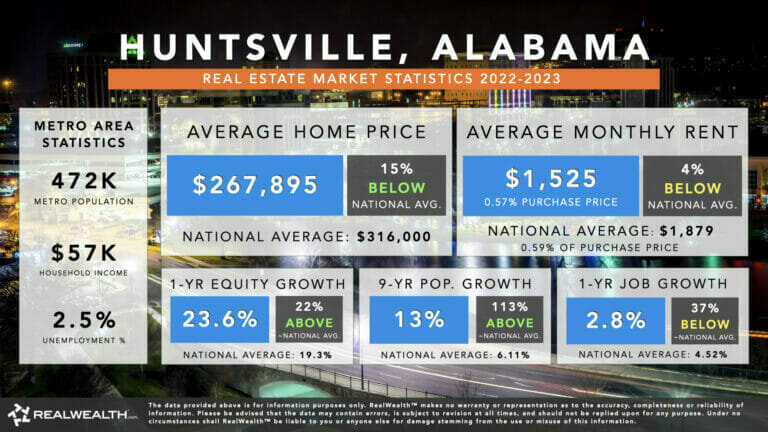

#13 – Huntsville, Alabama

Investors looking for a solid appreciation market rental property in 2022 should check out Huntsville’s real estate market. The job market is strong because of the rapidly growing population, affordable home prices (an average of $268,000 in the metro area) and strong equity growth potential – just in the last 12 months home values have risen by 24%, which is 22% higher than the national average. To learn more about why Huntsville makes our best places to buy rental property list, keep reading.

About the Huntsville Housing Market

The fourth-largest city in Alabama, Huntsville is just a 90-mile drive on the I-65 heading north from Birmingham. Founded in 1811, Huntsville is known for its rich Southern heritage and a legacy of space missions. Huntsville actually earned the nickname “The Rocket City” during the 1960s when the Saturn V rocket was developed at Marshall Space Flight Center, which later made it possible for Neil Armstrong and Buzz Aldrin to walk on the moon.

Today, Huntsville is one of the most well known cities in the Southeast part of the country. USA Today touted Huntsville as “one of the top communities leading the economic recovery,” while Money magazine named it “one of the nation’s most affordable cities.”

Huntsville is also well known for its technology, space, and defense industries. The top employer is the military with over 31,000 jobs at Redstone Arsenal. NASA Marshall Space Flight Center is the next largest employer. The city is also home to several Fortune 500 companies, which provide a broad base of manufacturing, retail, and service industries to the area.

The Coronavirus negatively impacted Huntsville’s job growth over the last year, but things are starting to turn around with almost 7,000 jobs created in the last 12 months. Plus, in the last few years, Alabama’s economic development projects have brought over $4.8 billion in new capital investment to the state. The projects in the works lay out a plan to bring 10,000 new jobs to the state in a wide range of industries – many of these jobs will be brought to Huntsville.

All in all, we believe that Huntsville is another one of the best places to buy rental property in 2022, because the real estate market offers great opportunities for investors today. It’s one of the nation’s most affordable investment markets, it has a steady job market that offers STEM workers above average salaries, and it has a growing population (38% of whom are renters). These are good signs for investors interested in generating passive monthly income.

Housing Market Statistics

- Median Household Income: $67,157

- Metro Population: 472,000

- 9-Year Population Growth: 13%

- Huntsville Metro Area Home Values & Rents:

- Median Home Price: $267,895

- Median Rent Per Month: $1,525 (0.57% price-to-rent ratio)

- 1-Year Equity Growth: 23.6%

- Job Growth: +6,900 CES jobs created over the last year

- 1-Year Job Growth Rate: 2.83%

- Unemployment Rate: 2.5%

Housing Market Quick Facts

- Huntsville is home to several prestigious Southern universities, including Alabama A&M University, Oakwood University and the University of Alabama in Huntsville.

- The U.S. Space & Rocket Center, Alabama’s top paid tourist attraction and the earth’s largest space museum, is also located in Huntsville.

- Huntsville is well known for its technology, space, and defense industries. The top employer is the military with over 31,000 jobs at Redstone Arsenal. NASA Marshall Space Flight Center is the next largest employer.

- Huntsville is also home to several Fortune 500 companies, which provide a broad base of manufacturing, retail and service industries to the area.

- Huntsville continues to lead the growth in Alabama. In the last nine years the population has grown over 13%, which is 105% faster than the national average.

- Huntsville enjoys lower tax rates and high rents, which increase ROI. And since the average home price is $268,000, this area won’t break your bank account either.

[Recap] Top 3 Reasons to Invest in the Huntsville Real Estate Market in 2022

To recap, here are the three primary factors that make Huntsville one of the best cities to invest in real estate in 2022.

Population Growth

Over the last 9 years, Huntsville’s population has increased 13%. During the same period, the national population grew by only 6%. This shows us that people are moving to Huntsville at a higher rate than most other cities across the United States. This type of population growth, when coupled with affordable real estate prices and job growth, are all positive indicators that the Huntsville real estate market is strong.

Affordability

The average home price in the Huntsville metro area is just under $268,000, which is 15% more affordable than the national average. Home values are also appreciating rapidly in Huntsville – in the last year alone there’s been a 24% jump. Both of these factors are good signs for investors interested in appreciation potential. To make things even more interesting, Alabama also has the second lowest property tax rate in the nation at just 0.40%.

Job Growth

Huntsville is well known for its technology, space, and defense industries. The top employer is the military with over 31,000 jobs at nearby Redstone Arsenal. NASA Marshall Space Flight Center is the next largest employer. The city is also home to several Fortune 500 companies, which provide a broad base of manufacturing, retail and service industries to the area. In the last 12 months, Huntsville created 6,900 new CES jobs, which is a growth rate of 2.83%.

#14 – Indianapolis, Indiana

Indianapolis is a very exciting real estate market for 2022 because it’s extremely affordable and the metropolitan area continues to grow at a much faster rate than the U.S. average, thanks to a varied and expanding job market. The average metro home price is $239,443 and the median rent is $1,413. That said, it is possible to find even better deals in Indianapolis. For example, one of our members recently closed on a 6 bedroom, 3 bathroom house in Indy that cost exactly $239,000. The property rents for $2,100 per month, which equates to $860 per month in cash flow if financed and a whopping $1,716 per month in cash flow if purchased all cash. There’s a lot to love about Indianapolis, so keep reading to learn more about investing in this market.

About the Indianapolis Housing Market

With a metro area of over 2.1 million people, Indianapolis is the 2nd largest city in the Midwest, the 14th largest in the U.S., and one of the very best real estate markets in Indiana.

The city of Indianapolis has poured billions of dollars into revitalization and now ranks among the best downtowns and most livable cities, according to Forbes.

Housing costs and the annual cost of living in Indianapolis are also well under the national average. Indy also has a strong, diverse job market, great schools and universities, and plenty of sports attractions.

Job growth in the Indianapolis metro has increased by 2.24% in the last 12 months and the unemployment rate is 4.10%. As mentioned above, it’s possible to find fantastic deals in Indianapolis that produce a large amount of passive income every month. Let’s just say that 2022 is a good time to become a landlord in Indianapolis.

Housing Market Statistics

- Median Household Income: $63,000

- Metro Population: 2.1 Million

- 9-Year Population Growth: 9.6%

- Indianapolis Metro Area Home Values & Rents:

- Median Home Price: $239,443

- Median Rent Per Month: $1,413 (0.59% price-to-rent ratio)

- 1-Year Equity Growth: 18.3%

- Job Growth: +23,600 CES jobs created over the last year

- 1-Year Job Growth Rate: 2.14%

- Unemployment Rate: 4.10%

Housing Market Quick Facts

- 3 Fortune 500 Companies have their headquarters in Indianapolis.

- 7 high-tech “Certified Technology Parks” with tax incentives to start-ups.

- Major distribution hubs including Fedex, Celadon Trucking, Amazon, Target.

- Indy is the ONLY U.S. metropolitan area to have specialized employment concentrations in all five bioscience sectors evaluated in the study: agricultural feedstock and chemicals; bioscience-related distribution; drugs and pharmaceuticals; medical devices and equipment; and research, testing, and medical laboratories.

[Recap] Top 3 Reasons to Invest in the Indianapolis Real Estate Market in 2022

Like most of the markets on this list, Indianapolis is a strong real estate market because it is affordable, the population is growing and the area is creating jobs. This is why it’s made our list of the best places to buy rental property in 2022. Here’s a recap:

Affordability

Indianapolis is among the few U.S. cities where you can purchase like-new, rental ready properties for as little as $170,000. In 2022, the average home price in the metro area is $239,443 and the median rent is $1,413. In the neighborhoods where RealWealth members invest its possible to lock in rents above $2,000 per month on comparably priced properties. This shows that Indianapolis is very affordable with offers a great opportunity to earn passive rental income.

Population Growth

With a metro area of over 2.1 million people, Indianapolis is the 2nd largest city in the Midwest and 14th largest in the U.S. Since 2012, Indy’s population has grown by 9.6%, which is 57% faster than the rest of the nation.

Job Growth

Indianapolis is one of the fastest growing hubs for technology, bioscience and Fortune 500 companies in the nation. In fact, Indy is the ONLY U.S. metropolitan area to have specialized employment concentrations in all five bioscience sectors evaluated in the study: agricultural feedstock and chemicals; bioscience-related distribution; drugs and pharmaceuticals; medical devices and equipment; and research, testing, and medical laboratories.

#15 – Jacksonville, Florida

The Jacksonville metropolitan area is one of the best places to invest in real estate in 2022, because of it’s rapidly growing population and higher than average appreciation rate. Homes in Jacksonville sell for an average of $315,000 and rent for $1,709, but in some neighborhoods it’s possible to find more affordable homes with higher rents. Real estate investors seeking excellent appreciation and decent cash flow should consider investing in the Jacksonville area.

About the Jacksonville Housing Market

Located on the eastern coast of Florida, Jacksonville lines both banks of the St. Johns River – the longest river in Florida and also one of only two rivers in North America that flows north instead of south.

In the past 9 years, the Jacksonville metro area has grown by almost 16%. To date, there are over 1.5 million people living in this area, and more continue to come every year. In fact, Jacksonville’s population has been steadily increasing at a rate of about 2% per year, and their workforce has been growing at a consistent rate as well.

There are many reasons for this growth. For starters, Jacksonville is the only Florida city that is home to four Fortune 500 companies. The region also has a world-class health care system, with more than 20 hospitals and a growing bioscience community. Additionally, 13 of Forbes Global 500 have operations in Jacksonville.

Jacksonville has three seaports, four airports and an immense highway and rail system. A large contributor to Jacksonville’s economy is the auto parts industry. There are two major distribution centers in the area, Southeast Toyota (the largest distributor in the country) and General Motors Corp. Within its city limits, Jacksonville has the third-largest military presence in the entire nation. Importing and exporting are another huge source of revenue for Jacksonville as well as the state of Florida.

With a cost of living below the national average, a wonderful climate and a business-friendly environment, we believe Jacksonville is one of the best real estate investment markets in the country right now. It also has a lower than national average tax rate for real estate.

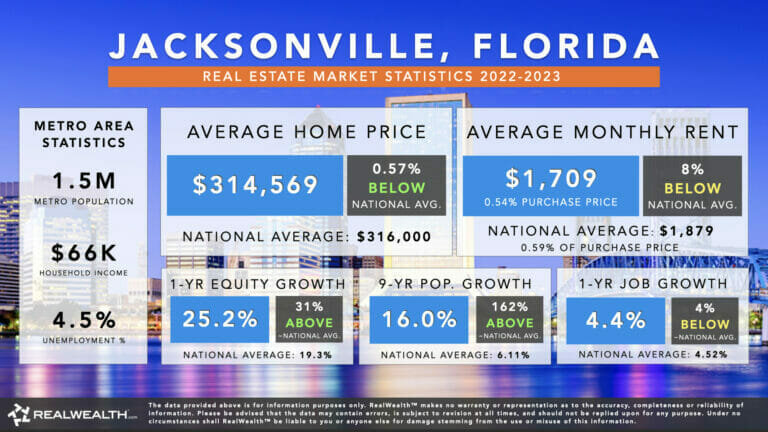

Housing Market Statistics

- Metro Population: 1.5 Million

- 9-Year Population Growth: 16%

- Jacksonville Metro Area Home Values & Rents:

- Median Home Price: $314,569

- Median Rent Per Month: $1,709 (0.54% price-to-rent ratio)

- 1-Year Equity Growth: 25.2%

- Job Growth: +31,100 CES jobs created over the last year

- 1-Year Job Growth Rate: 4.35%

- Unemployment Rate: 4.5%

Housing Market Quick Facts

- The population in Jacksonville has grown about 16% since 2010, which is higher than Miami and Tampa, respectively.

- Future job growth in Jacksonville is predicted to be 44% over the next 10 years.

- In Jacksonville, the median home price is about $315,000, which is slightly less than the national average. A typical home can rent for around $1,709 or more.

- The expansion of the Panama Canal is helping to bring jobs into the Jacksonville area ports. This is likely to lead to even more population growth.

- The Jacksonville metro also has a world-class health care system, with more than 20 hospitals and a growing bioscience community.

[Recap] Top 3 Reasons to Invest in the Jacksonville Real Estate Market in 2022

As mentioned throughout this article, there are three main reasons that Jacksonville made our list of the best places to invest in property: job growth, population growth and affordability.

Population Growth

The population in Jacksonville has grown 16% since 2010, and continues to grow by an average 3% annually. Future job growth over the next ten years is predicted to be over 44%.

Affordability

In Jacksonville, the median home price is about $315,000, which is just under the national average. A typical home can rent for around $1,709. In the areas where RealWealth members invest, you can secure average monthly rents of over $2,100 for properties costing around $300,000. These factors show us that there’s a strong opportunity for cash flow in the Jacksonville metro.

Job Growth

Jacksonville is one of the best cities in the U.S. for jobs. In a typical year, the average yearly job growth rate is right around 3%. Over the next decade, job growth in the Jacksonville metro area is expected to increase 44%. The region also has a world-class health care system, with more than 20 hospitals and a growing bioscience community.

#16 – Ocala

Located in North Central Florida, Ocala is a strong real estate market for 2022. It offers affordability, solid monthly cash flow and rapid equity growth. The population is also growing exponentially, which is a great sign that home values and rents will continue rising in coming years. The average home value in Ocala is currently $219,957 and average rents are $1,366, which is a 0.62% price to rent ratio. In some neighborhoods it’s possible to find even more affordable investment properties that generate higher rents.

About the Ocala Housing Market

Ocala is a small city in north central Florida, about 60 miles east of the famous Daytona Beach and 70 miles north of Orlando. It is a very charming city known for its tree-lined streets, homes in the style of the Old South and miles of pristine nature.

Ocala is also home to over 400 thoroughbred farms and training centers, including the 500-acre Florida Horse Park. This property is the official training site for the U.S. Equestrian Team and the host of many nationally recognized events and Olympic-level competitions. It’s therefore no wonder that the city was named the Horse Capital of the World in 2007.

Investors flock to Ocala, not for the horses, but for affordable investment properties starting around $200,000, solid monthly cash flow and a huge opportunity for appreciation – just in the last year, Ocala home values rose by over 25% – 30% faster than the national average.

Ocala is also experiencing a 10% increase in its population in the last 10 years – people are flocking here due to its affordable cost of living, central location to beaches and jobs, and the area’s natural wonders like the Ocala National Forest.

Ocala is a wonderful place to live for nature enthusiasts, horse trainers, and those looking for a small town lifestyle close to Florida’s big cities. Ocala is a good place to invest for those looking for $200,000 investment properties that can appreciate while also offering stable monthly cash flow. For all of these reasons, we think Ocala is one of the best places to invest in real estate in 2022.

Housing Market Statistics

- Median Household Income: $50,000

- Metro Population: 366,000

- 9-Year Population Growth: 10.3%

- Ocala Metro Area Home Values & Rents:

- Median Home Price: $219,957

- Median Rent Per Month: $1,366 (0.62% price-to-rent ratio)

- 1-Year Equity Growth: 25.2%

- Job Growth: +2,000 CES jobs created over the last year

- 1-Year Job Growth Rate: 1.86%

- Unemployment Rate: 5%

Housing Market Quick Facts

- Ocala is known as the horse capital of the world. As such, horse breeding, training and related occupations equate to over 40,000 jobs.

- The HQ of the E-One Emergency vehicles plant is in Ocala. This company is a global manufacturer of emergency vehicles, trucks and vans. The area is also home to manufacturing companies that make missiles, storage units and shelving.

- Ocala offers an affordable opportunity for real estate investors with a median home price of less than $220,000. This makes the area 30% more affordable than the national average.

- Ocala provides investors with a strong appreciation opportunity – just in the last 12 months home values in Ocala have risen by 25.2% (30% above the national average).

- People are moving to Ocala at a large rate. In the last 10 years the population has grown by over 10%, which is 69% faster than the national average.

[Recap] Top 3 Reasons to Invest in the Ocala Real Estate Market in 2022

Population Growth

With a metro population of 365,600 residents, the city of Ocala has grown by almost 10% since 2010. The influx of people moving to the area can largely be attributed to a lower cost of living compared to other areas in Florida.

Affordability

Average home value in Ocala is $220,000, making it 30% more affordable than the national average. In the last year, home values have risen by over 25%, which is much higher than the national average of 19%.

Job Growth

Ocala created over 2,000 CES jobs over the last year, which is a job growth rate of 1.86%. Although this is lower than the national average, it’s still solid growth.

#17 – Orlando, Florida

Orlando’s is another strong housing market for 2022. Its population growth has been exceptionally fast and the job market is strong. In the Orlando metro area, the average home costs $333,000 and the median rent is $1,850. It’s also possible to find even more affordable prices in certain neighborhoods and also lock in similar rents. For example, one property recently purchased by a RealWealth member cost $214,000 and rents for $1,650, which is a 0.77% price to rent ratio. Learn more about all the investment opportunities the Orlando real estate market has to offer in 2022 below.

About the Orlando Housing Market

The demand for single family homes has been on the rise in the Sunshine State for quite some time. Still, it’s possible to acquire fully renovated properties in good Florida neighborhoods for as little as $215,000.

What’s even more interesting is that, despite these incredibly low housing prices statewide, many home seekers are choosing to rent instead of buy. As you can imagine, this is causing rental rates to rise and are expected to keep going up in 2022.

On top of great cash flow, values are on an upswing in Orlando with no sign of slowing down. They are nowhere near their 2006 highs and inventory levels are still way down because builders just can’t make a profit at these price points.

Property taxes and insurance are also low in Orlando, plus there’s no state income tax in Florida. Add warm weather and exceptional health care, and you can see why many of the 10,000 baby boomers retiring every day are moving to Florida.

Orlando also boasts a rapidly growing population fueled by job seekers, baby boomer retirees, and students who want to live in a “cheap and cheerful” area that offers a high quality of living at a reasonable cost. There are several theme parks in the surrounding area including, Universal Orlando, Walt Disney World, the Magic Kingdom and Epcot.

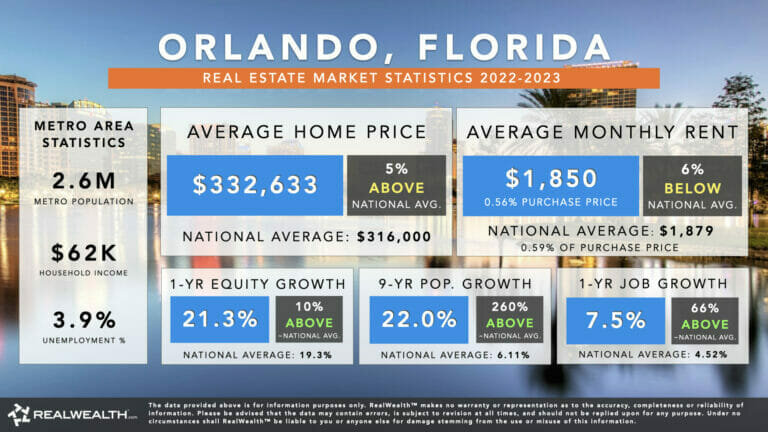

Housing Market Statistics

- Median Household Income: $62,000

- Metro Population: 2.6 Million

- 9-Year Population Growth: 22%

- Orlando Metro Area Home Values & Rents:

- Median Home Price: $332,633

- Median Rent Per Month: $1,850 (0.5% price-to-rent ratio)

- 1-Year Equity Growth: 21.3%

- Job Growth: +87,900 CES jobs created over the last year

- 1-Year Job Growth Rate: 7.5%

- Unemployment Rate: 3.90%

Housing Market Quick Facts

- Orlando was listed as the #1 Best Places to Buy a House by Forbes for three year in a row. Home values have also appreciated by over 22% in the last year – 10% higher than the national average.

- Metro Orlando is the 4th largest metro area in the country, and it’s also the fastest growing metro in the nation.

- In a typical year, Orlando is the most visited tourism destination in the country.

- The population in Orlando has grown over 22% since the year 2010. To date, Metro Orlando houses over 2.6 million residents.

- Orlando’s projected job growth for the next ten years is the highest in the United States among the 200 largest metros, according to Forbes.

- Orlando Medical City boasts a $7.6 billion economic impact and plans to create over 45,000 jobs.

[Recap] Top 3 Reasons to Invest in the Orlando Real Estate Market in 2022